CMA Cart

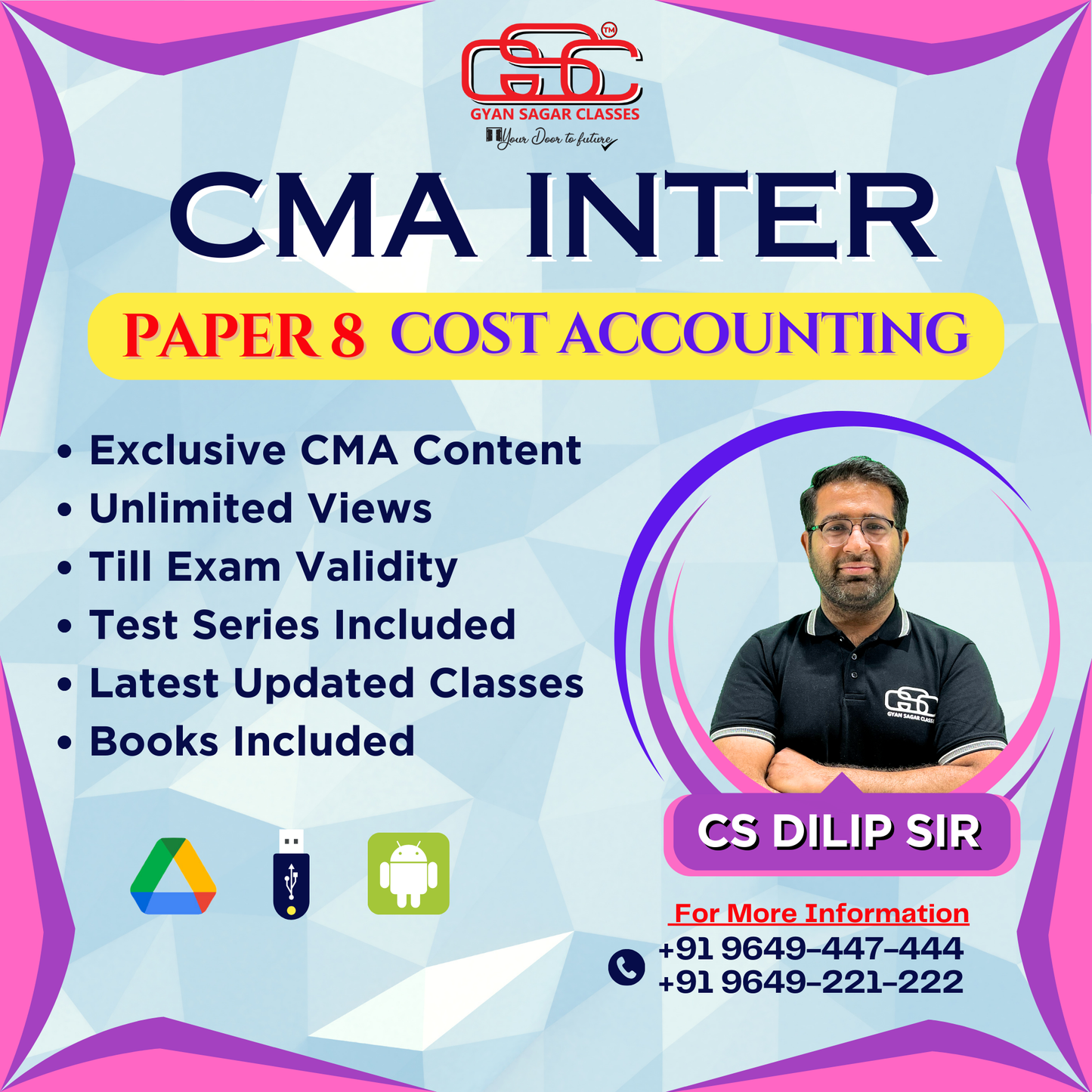

CMA Inter Cost Accounting (CA)

CMA Inter Cost Accounting (CA)

Couldn't load pickup availability

Product Information

| Mode |

Download Link with Hard-Book

|

| Duration | Lectures:- 160 (Duration:- 140 – 150 Hours) |

| Video Language | Hindi |

| Faculty Name | CS Dilip Sir |

| Course Material Language | English |

| Video Run on | Computer / Laptop / Android Mobile (Video Lectures Do Not Run on Apple Device Please Check FAQ) |

| Study Material | Hard Book |

| Package Details | Video Lectures + Study Material |

| Exams validity | Till Exam |

| Doubt Solving Facility | Email, WhatsApp, Call |

| Delivery Free Delivery | Non Cancellable |

| Product Dispatch | Within 24 to 48 Working Hours |

| Total No. Views | Unlimited Views (Till Exam) |

Content As Per Syllabus

SECTION A: INTRODUCTION TO COST ACCOUNTING

Module 1. Introduction to Cost Accounting 1.1. Introduction 1.2. Important Cost Accounting Terms 1.3. Elements of Cost 1.4. Classification of Cost 1.5. Preparation of Cost Sheet and Ascertainment of Profit

Module 2. Cost Ascertainment – Elements of Cost 2.1 Material Costs 2.1.1 Procurement of Materials 2.1.2 Inventory Management and Control 2.1.3 Inventory Accounting and Valuation 2.1.4 Physical Verification, Slow and Non-moving Stock and Treatment of Losses 2.1.5 Scrap, Spoilage, Defectives and Wastages 2.2 Employee Costs 2.2.1 Time Keeping, Time Booking and Payroll 2.2.2 Principles and Methods of Remuneration and Incentive Schemes 2.2.3 Overtime and Idle Time 2.2.4 Employee Cost Reporting 2.2.5 Labour Turnover 2.3 Direct Expenses 2.3.1 Definition and Examples 2.3.2 Nature of Direct Expense 2.3.3 Direct vs. Indirect Expense 2.4 Overheads 2.4.1 Collection, Classification, Apportionment and Allocation of Overheads 2.4.2 Absorption and Treatment of Over or Under Absorption of Overheads 2.4.3 Reporting of Overhead Costs

Module 3. Cost Accounting Standards (CAS 1 to CAS 24)

Module 4. Cost Book Keeping 4.1 Cost Book - Keeping 4.2 Reconciliation of Costing and Financial Profit 4.3 Integrated Accounting System

SECTION B: METHODS OF COSTING

Module 5. Methods of Costing 5.1 Job Costing 5.2 Batch Costing 5.3 Contract Costing 5.4 Process Costing – Normal and Abnormal Losses, Equivalent Production, Interprocess Profit, Joint and By Products 5.5 Operating Costing – Transport, Hotel and HealthcareSECTION C: COST ACCOUNTING TECHNIQUES

Module 6. Cost Accounting Techniques 6.1 Marginal Costing 6.1.1 Concept of Marginal Cost and Marginal Costing 6.1.2 Absorption Costing vs. Marginal Costing 6.1.3 CVP Analysis 6.1.4 Margin of Safety 6.1.5 Application of Marginal Costing for Decision Making 6.2 Standard Costing and Variance Analysis 6.2.1 Concept of Standard Cost and Standard Costing 6.2.2 Advantages and Limitations 6.2.3 Computation and Analysis of Variances (Material and Labour Costs only) 6.3 Budget and Budgetary Control 6.3.1 Concepts, Types of Budget 6.3.2 Budgetary Control vs. Standard Costing 6.3.3 Advantages and Limitations 6.3.4 Preparation of BudgetsShare