CMA Cart

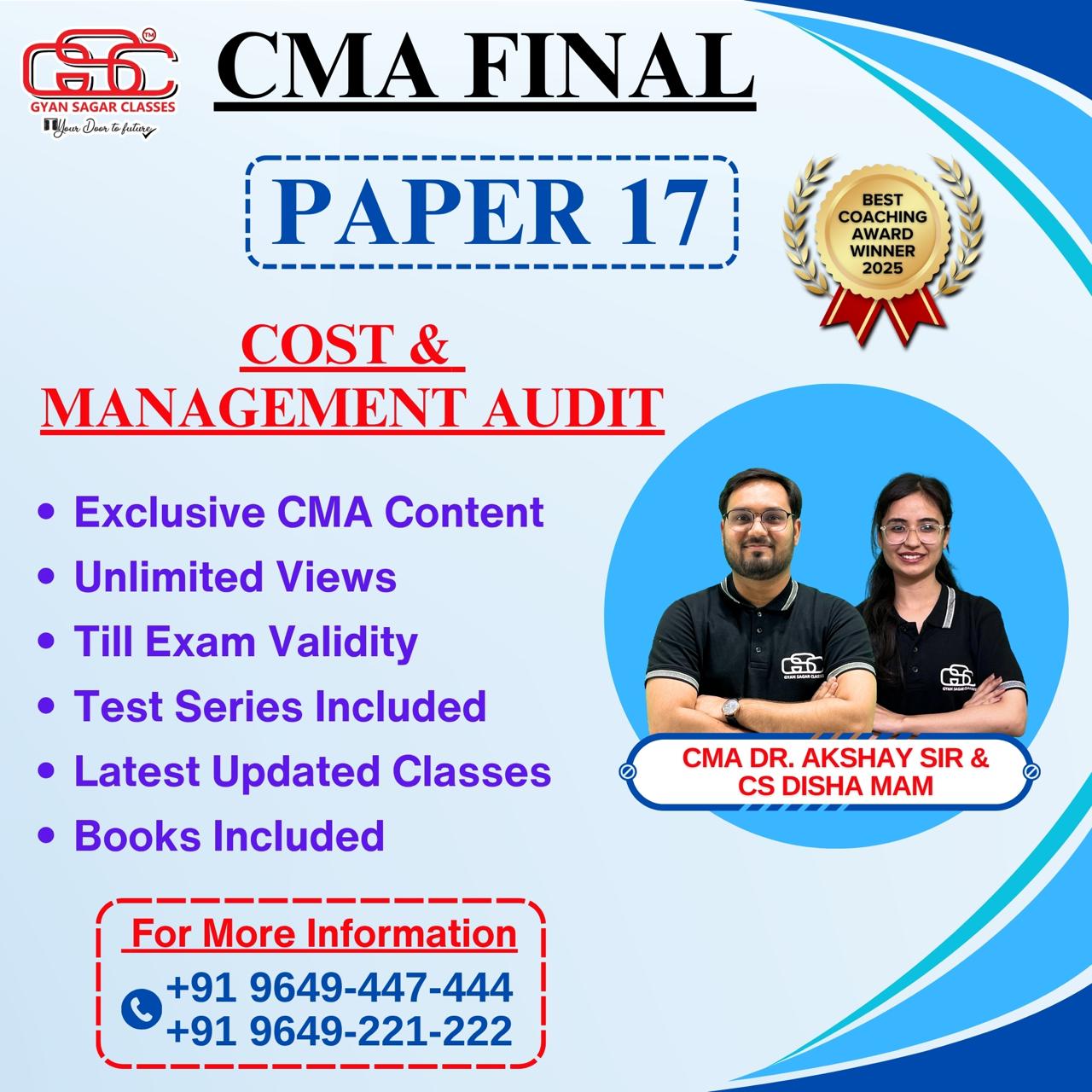

Cost And Management Audit (CMAD)

Cost And Management Audit (CMAD)

Couldn't load pickup availability

Product Information

| Mode |

Download Link with Hard-Book

|

| Duration | Lectures:- 110 (Duration:- 90 – 100 Hours) |

| Video Language | Hindi |

| Faculty Name | CMA Akshay Sir & CS Disha Mam |

| Course Material Language | English |

| Video Run on | Computer / Laptop / Android Mobile (Video Lectures Do Not Run on Apple Device Please Check FAQ) |

| Study Material | Hard Book |

| Package Details | Video Lectures + Study Material |

| Exams validity | Till Exam |

| Doubt Solving Facility | Email, WhatsApp, Call |

| Delivery Free Delivery | Non Cancellable |

| Product Dispatch | Within 24 to 48 Working Hours |

| Total No. Views | Unlimited Views (Till Exam) |

Content As Per Syllabus:

SECTION A: COST AUDIT

Module 1. Basics of Cost Audit 1.1 Nature and Scope of Cost Audit 1.2 Genesis of Cost Audit 1.3 Objectives of Cost Audit 1.4 Utility and Advantage of Cost Audit 1.5 Cost Accounting Standards

Module 2. Companies (Cost Records and Audit) Rules, 2014 (as amended) 2.1 Companies (Cost Records and Audit) Rules, 2014 (as amended)

Module 3. Cost Auditor 3.1 Definition 3.2 Cost Auditor’s Eligibility, Qualifications, Disqualifications, Appointment, Registration, Rotation, Remuneration, Removal, Rights and Duties, Liabilities 3.3 Professional Ethics 3.4 Duties of a Cost Auditor to Report Fraud - Section 143 of the Companies Act 2013 3.5 Punishment for Fraud (Section 447 of the Companies Act, 2013) 3.6 Punishment for False Statement (Section 448 of the Companies Act, 2013)

Module 4. Overview of Cost Accounting Standards and GACAP 4.1 Cost Accounting Standards 4.2 Guidance Notes on Cost Accounting Standards 4.3 Generally Accepted Cost Accounting Principles (GACAP)

Module 5. Cost Auditing and Assurance Standards 5.1 Cost Auditing Standards - Overview

Module 6. Cost AuditProgramme 6.1 Introduction 6.2 Factors in Planning Cost Audit Assignment 6.3 Cost Audit Programme

Module 7. Cost Audit Documentation, Audit Process and Execution 7.1 Cost Audit Documentation 7.2 Audit Process 7.3 Practical Steps of Audit Process

Module 8. Preparation and Filing of Cost Audit Report 8.1 Introduction 8.2 Critical Elements of Cost Audit Report and Related Evidences (Physical and Digital) 8.3 Qualified Audit Report 8.4 Adverse Audit Report 8.5 Filing of Cost Audit Report to MCA in XBRL Format (as per TAXONOMY)

SECTION - B: MANAGEMENT AUDIT

Module 9. Basics of Management Audit 9.1 Definition 9.2 Nature and Scope 9.3 Need for Management Audit and Reporting 9.4 Audit of Management Process and Functions 9.5 Establishing Reliability of Information 9.6 Role of CMAs in Management Audit

Module 10. Management Reporting Issues and Analysis 10.2 Performance Analysis 10.3 Capacity Utilisation Analysis 10.4 Productivity and Efficiency Analysis 10.5 Utilities and Energy Efficiency Analysis 10.6 Key Costs and Contricbution Analysis 10.7 Probability Analysis 10.8 Working Capital and Liquidity Management Analysis 10.9 Manpower Analysis 10.10 Other Areas Suggested to be covered in the Report on Performance Analysis 10.11 Management Accounting Tools

Module 11. Management Audit in Different Functions 11.1 Corporate Objectives and Culture 11.2 Corporate Services Audit 11.3 Corporate Development Audit 11.4 Evaluation of Personnel Development 11.5 Consumer Services Audit 11.6 Audit of Environmental Pollution Control 11.7 Audit of Energy and Utilities-Generation and Consumption 11.8 Productivity Audit / Efficiency Audit 11.9 Propriety Audit 11.10Corporate Social Responsibility (CSR) Audit 11.11 Social Cost-Benefit Analysis Audit

Module 12. Evaluation of Corporate Image 12.1 Introduction 12.2 Audit Checks of Different Managerial Functions 12.3 Audit Checks of Various Corporate Divisions/Departments 12.4 ESG Audit

Module 13. Informatin Systems Security Audit 13.1 Overviews 13.2 Compliance and Security Framework 13.3 Cyber Security and Cyber Forensics 13.4 IT Audit in Banking Sector

SECTION - C: INTERNAL CONTROL, INTERNAL AUDIT, OPERATIONAL AUDIT AND OTHER RELATED ISSUES

Module 14. Internal Control and Internal Audit 14.1 Internal Control-Concept 14.2 Internal Control and the Auditor 14.3 Internal Auditing – Evolution of the Profession

Module 15. Operatinal Audit and Internal Audit under Companies Act, 2013 15.1 Introduction 15.2 Preparation for an Audit 15.3 Audit Engagement Letter 15.4 Role of CMAs in Internal Audit and Operational Audit 15.5 Internal Audit under Companies Act, 2013 15.6 Internal Audit and Companies (Auditor’s Report) Order 15.7 Internal Audit in Companies under manufacturing sector

Module 16. Audit of Diefferent Service Organisations 16.1 Audit of Hospitals 16.2 Audit of Hotels 16.3 Audit of Educational Institutions 16.4 Audit of Co-operative Societies 16.5 Audit of Self-Help Groups 16.6 Audit of Non-Government Organisations (NGOs) 16.7 Audit of Local Bodies 16.8 Audit of Government Expenditure 16.9 Propriety Audit in the context of Government Audit 16.10Audit of Commercial Accounts

SECTION - D: FORENSIC AUDIT AND ANTI-MONEY LAUNDERING

Module 17. Forensic Audit 17.1 Introduction to Forensic Audit 17.2 Fraud Risk Management 17.3 Financial Forensics and Forensic Audit Techniques 17.4 Ethical Considerations and Code of Conduct in Forensic Audit 17.5 Professional Opportunities

Module 18. Anti-Money Laundering 18.1 International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation 18.2 Guidance for a Risk-Based Approach for the Accounting Profession

Share