CMA Cart

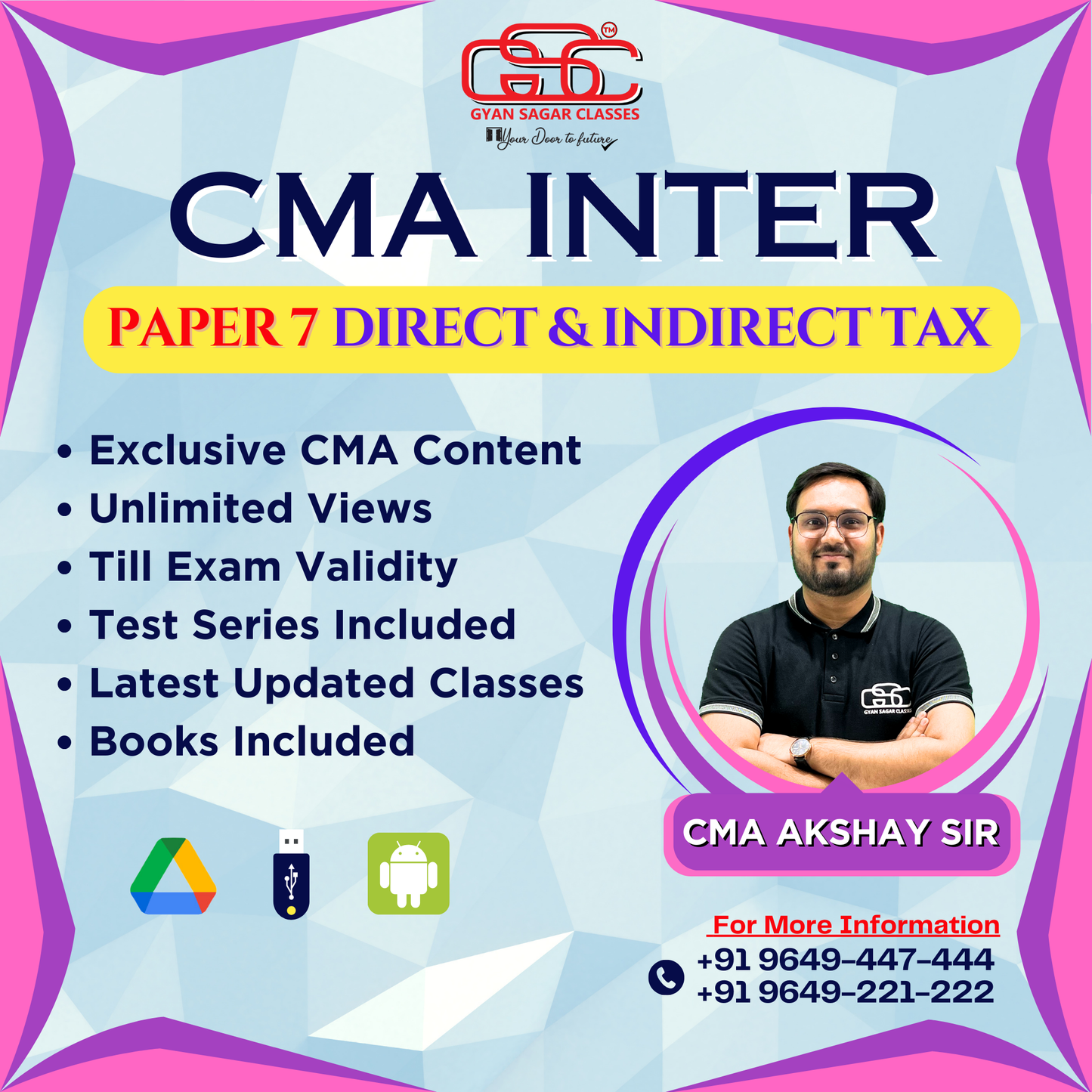

CMA Inter Direct And Indirect Taxation (DITX)

CMA Inter Direct And Indirect Taxation (DITX)

Couldn't load pickup availability

Product Information

| Mode |

Download Link with Hard-Book

|

| Duration | Lectures:- 190 (Duration:- 160 – 170 Hours) |

| Video Language | Hindi |

| Faculty Name | CMA Akshay Sir |

| Course Material Language | English |

| Video Run on | Computer / Laptop / Android Mobile (Video Lectures Do Not Run on Apple Device Please Check FAQ) |

| Study Material | Hard Book |

| Package Details | Video Lectures + Study Material |

| Exams validity | Till Exam |

| Doubt Solving Facility | Email, WhatsApp, Call |

| Delivery Free Delivery | Non Cancellable |

| Product Dispatch | Within 24 to 48 Working Hours |

| Total No. Views | Unlimited Views (Till Exam) |

Content As Per Syllabus

SECTION A : DIRECT TAXATION

Module 1. Basics of Income Tax Act 1.1 Basic Concepts, Basis of Charge and Capital & Revenue Receipts 1.2 Residential Status and Scope of Total Income 1.3 Agricultural Income 1.4 Income which do not form part of Total Income

Module 2. Heads of Income 2.1 Salaries 2.2 Income from House Property 2.3 Profits and Gains of Business or Profession including Tax Audit u/s 44AB; and Provisions u/s 43A, 43B, 43AA, 44AD, 44ADA and 44AE (excluding Sections 42 to 44DB) 2.4 Capital Gains 2.5 Income from Other Sources

Module 3. Total Income and Tax Liability of Individuals & HUF 3.1 Income of Other Person included in Assesses Total Income (Clubbing of Income) 3.2 Set off and Carry Forward of Losses 3.3 Deductions, Rebate and Relief 3.4 Taxation of Individual (including AMT but excluding Non-resident) & HUF 3.5 Advance Tax 3.6 Tax Deducted at Source & Tax Collected at Source (excluding Non-resident) 3.7 Filing of Return of Income 3.8 PAN 3.9 Self-Assessment & Intimation

SECTION B: INDIRECT TAXATION

Module 4. Concept of Indirect Taxes 4.1 Concept and Features of Indirect Taxes 4.2 Difference between Direct and Indirect Taxes 4.3 Background of erstwhile Indirect Taxes (Central Excise, VAT etc.) 4.4 Constitutional Validity of GST

Module 5. Goods and Services Tax (GST) Laws 5.1 Introduction to GST Law 5.2 Levy and Collection of CGST and IGST 5.3 Basic concepts of Time and Value of Supply 5.4 Input Tax Credit 5.5 Computation of GST Liability 5.6 Registration 5.7 Tax Invoice – Electronic Way Bill 5.8 Returns and Payment of Taxes

Module 6. Customs Act & Rules 6.1 Customs Act-Basic Concepts and Definitions 6.2 Types of Duties 6.3 Valuation Rules 6.4 Computation of Assessable Value and Duties

Share