CMA Cart

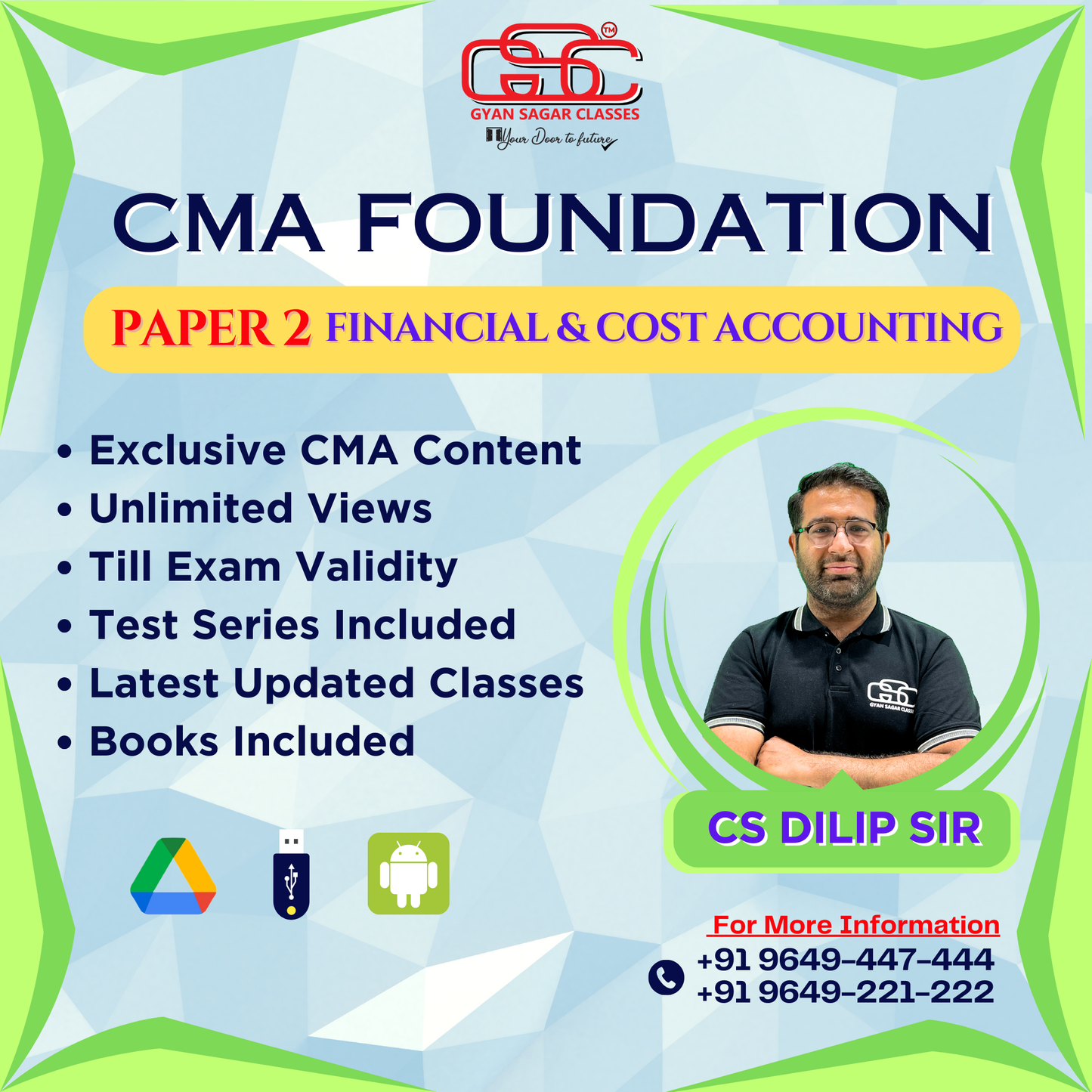

Fundamentals Of Financial And Cost Accounting (FSCA)

Fundamentals Of Financial And Cost Accounting (FSCA)

Couldn't load pickup availability

Product Information

| Mode |

Download Link with Hard-Book

|

| Duration | Lectures:- 100 (Duration:- 80-90 Hours) |

| Video Language | Hindi |

| Faculty Name | CS Dilip Sir |

| Course Material Language | English |

| Video Run on | Computer / Laptop / Android Mobile (Video Lectures Do Not Run on Apple Device) Please Check FAQ) |

| Study Material | Hard Book |

| Package Details | Video Lectures + Study Material |

| Exams validity | Till Exam |

| Doubt Solving Facility | Email, WhatsApp, Call |

| Delivery Free Delivery | Non Cancellable |

| Product Dispatch | Within 24 to 48 Working Hours |

| Total No. Views | Unlimited Views (Till Exam) |

Content As Per Syllabus

SECTION A: FUNDAMENTALS OF FINANCIAL ACCOUNTING

Module 1. Accounting Fundamentals 1.1 Understanding of Four Frameworks of Accounting (Conceptual, Legal, Institutional and Regulatory) and Forms of Organisation 1.2 Accounting Principles, Concepts and Conventions 1.3 Capital and Revenue Transactions - Capital and Revenue Expenditures, Capital and Revenue Receipts 1.4 Accounting Cycle – Charts of Accounts and Codification Structure, Analysis of Transaction – Accounting Equation, Double Entry System, Books of Original Entry, Subsidiary Books and Finalisation of Accounts 1.5 Journal (Day Books; Journal Proper – Opening, Transfer, Closing, Adjustment and Rectification Entries), Ledger 1.6 Cash Book, Bank Book, Petty Cash Book, Bank Reconciliation Statment 1.7 Trial Balance 1.8 Adjustment Entries and Rectification of Errors 1.9 Depreciation (Straight Line and Diminishing Balance methods only) 1.10 Accounting Treatment of Bad Debts and Provision for Doubtful Debts

Module 2. Accounting for Special Transactions 2.1 Consignment 2.2 Joint Venture 2.3 Bills of Exchange (excluding Accommodation Bill, Insolvency)

Module 3. Preparation of Final Accounts 3.1 Preparation of Financial Statements of Sole Proprietorship 3.1.1 Income Statement, Balance Sheet 3.2 Preparation of Financial Statements of a Not-for-Profit Orgnisation 3.2.1 Preparation of Receipts and Payments Account 3.2.2 Preparation of Income and Expenditure Account 3.2.3 Preparation of Balance Sheet

SECTION B: FUNDAMENTALS OF COST ACCOUNTING

Module 4. Fundamentals of Cost Accounting 4.1 Meaning, Definition, Significance of Cost Accounting, its Relationship with Financial Accounting 4.2 Application of Cost Accounting for Business Decisions 4.3 Definition of Cost, Cost Centre, Cost Unit and Cost Drivers 4.4 Classification of Costs (with reference to Cost Accounting Standard 1) 4.5 Ascertainment of Cost and Preparation of Statement of Cost and Profit (Cost Sheet)Share